OVERVIEW

PSS METATRADER 4 TRADING PLATFORM

The choice for millions of traders around the world.

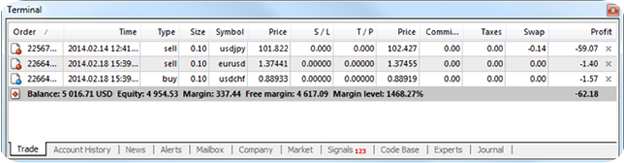

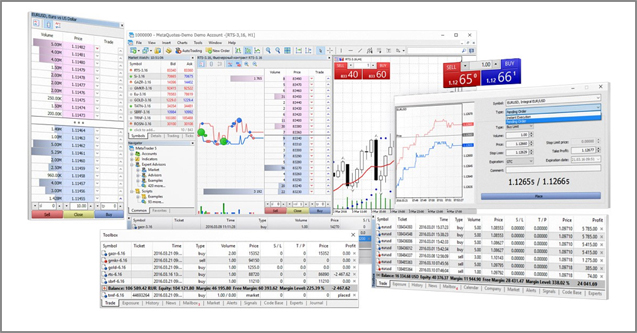

The platform offers advanced trading functions, as well as superior tools for analysis. MetaTrader can also trade automatically by using trading robots and signal trading. In addition, our platform is available for all browser, desktop and mobile devices.

Powerful Trading System

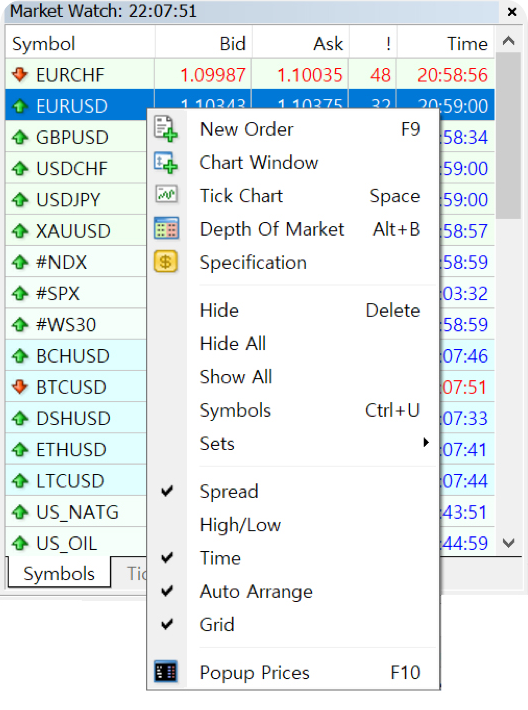

- Trade any securities from a single platform

- Use alerts and capture all opportunities right from your mobiles

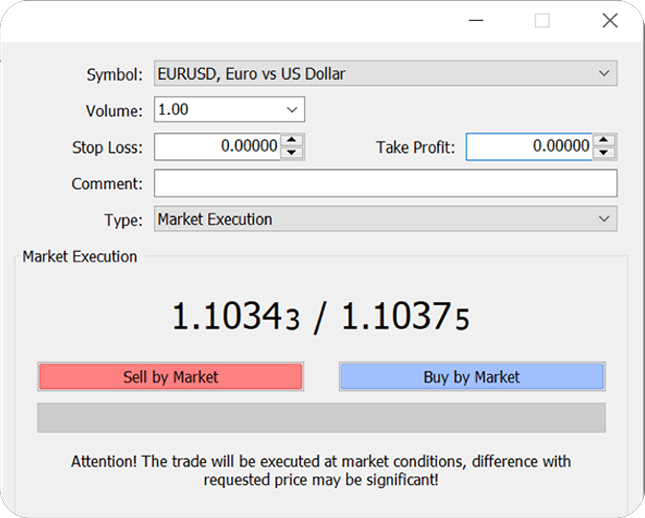

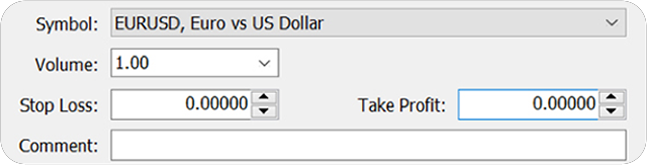

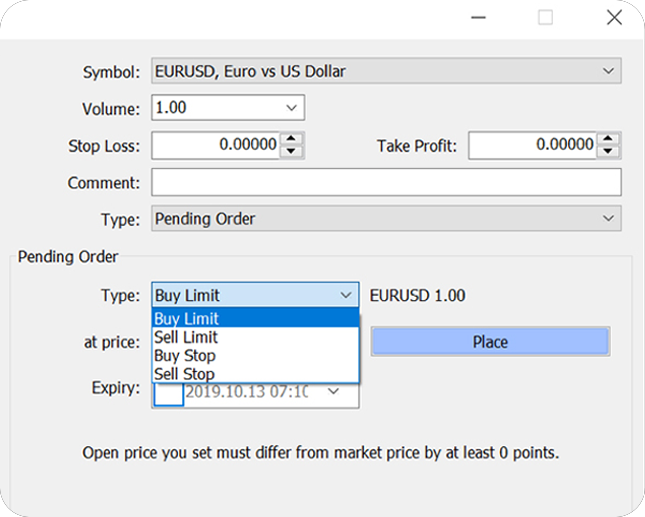

- A wide range of orders which can also be placed directly from charts

- 44 built-in analytical objects for a comprehensive analysis

- 38 built-in technical indicators for professional technical analysis

OPEN DEMO ACCOUNT

A risk-free demo account is opened automatically when you access the Trade menu from the PSS website and the same account can be accessed when you visit the page again, even after you’ve closed the internet browser. If you’d like to open a new demo account, you can do so by completing the account registration from the Trade menu.

Steps to open a new demo account

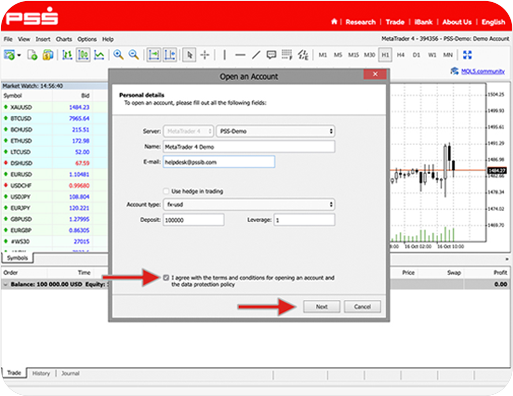

A. Click File menu from Trade page and then choose Open a Demo Account.

B. Complete the Personal Details and click to agree Terms and Conditions.

Then click Next to complete the demo account creation.

LOGIN TO A LIVE ACCOUNT

Once you completed the live trading account registration and received your login details from PSS by email, you can trade live from the Trade menu using the credentials.

Steps to trade access your live trading account

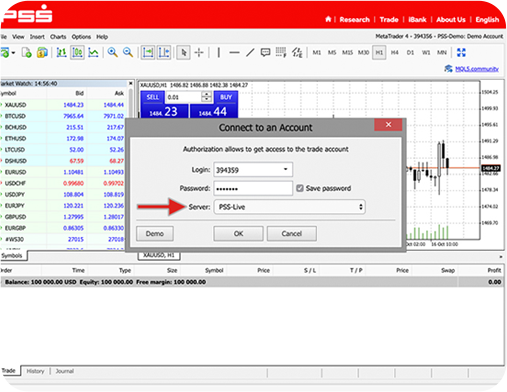

A. Click File menu from Trade page and then choose Login to Trade Account.

B. Enter your account number and password and then click ok after choosing PSS-Live from the Server option.